Something I think about often, every time someone says “let’s brainstorm ideas” are the rules needed for successful brainstorming. Who better to get these rules from than Walt Disney Imagineering (WDI). This excerpt is from the wonderful little book: The Imagineering Field Guide to Disneyland

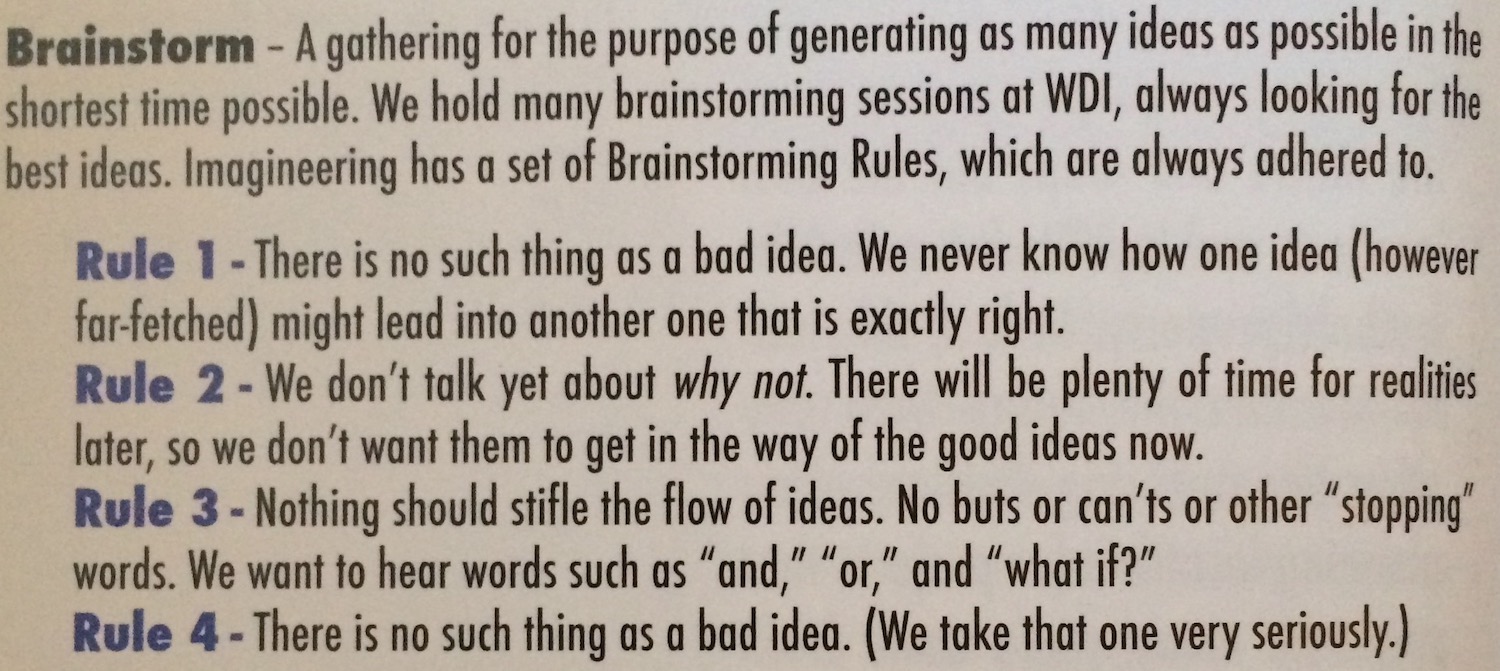

- Rule 1: There is no such thing as a bad idea. We never know how one idea (however far-fetched) might lead into another one that is exactly right.

- Rule 2: We don’t talk yet about why not. There will be plenty of time for realities later, so we don’t want them to get in the way of the good ideas now.

- Rule 3: Nothing should stifle the flow of ideas. No buts or can’ts or other stopping words. We want to hear words such as “and”, “or”, and “what if?”.

- Rule 4: There is no such thing as a bad idea. (We take that one very seriously).

Other, related definitions from the “Imagineering Lingo” section of the book:

Blue Sky – The early stages in the idea-generation process when anything is possible. There are not yet any considerations taken into account that might rein in the creative process. At this point, the sky’s the limit!

Brainstorm – A gathering for the purpose of generating as many ideas as possible in the shortest time possible. We hold many brainstorming sessions at WDI (Walt Disney Imagineering), always looking for the best ideas. Imagineering has a set of Brainstorming Rules, which are always adhered to.

Charrette – Another term for a brainstorming session. From the French word for “cart”. It refers to the cart sent through the Latin Quarter in Paris to collect the art and design projects of students at the legendary École des Beaux-Arts who were unable to deliver them to the school themselves after the mad rush to complete their work at the end of the term.

This book is a fun little read if you’re at all interested in the history or design of Disneyland and can be a great spark for creativity. Highly recommended: The Imagineering Field Guide to Disneyland